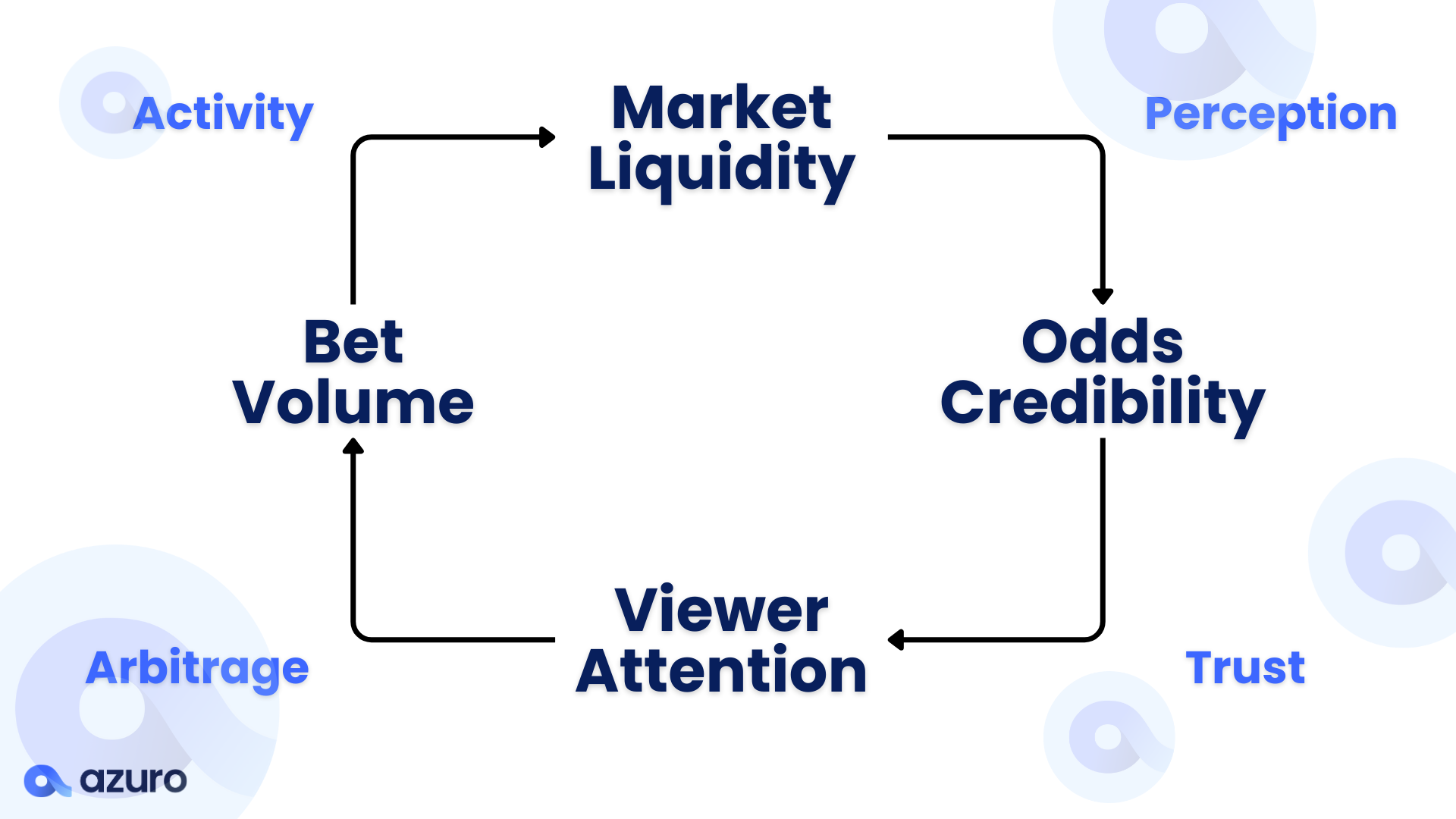

The Bettor-Viewer Flywheel

Betting and prediction markets are not mutually exclusive. Betting volumes contribute to the liquidity stock of a well-functioning prediction market, and the more liquidity is involved in a prediction market, the more accurate its odds will be perceived, since there are more people with skin-in-the-game and more monetary resources at-stake in that said prediction market.

An efficient prediction market is the result of two thriving yet distinct user groups feeding off each other: profit-seeking bettors who form the “money base” of the market, and information-curious viewers who form the “attention base” of the market.

- Increased attention helps get prediction markets to the eyes of profit-seeking bettors;

- Bettors place bets against what they deem to be mispriced odds on a prediction market, contributing to that market’s volume and repricing of odds;

- Interested viewers put greater weight on the accuracy of the prediction market due to the increased volumes, increasing attention and attracting more bettors into the mix;

- Bettors place increasingly sized bets against the prediction market’s odds as open interest (OI) grows and the market becomes able to take in top-dollar bets;

- Volumes boom, and viewers increasingly regard the prediction market as the source of truth for that event, further increasing its popularity which attracts more bettor eyeballs;

- ad infinitum.