Oddsmaking: Sell-side vs. Buy-side

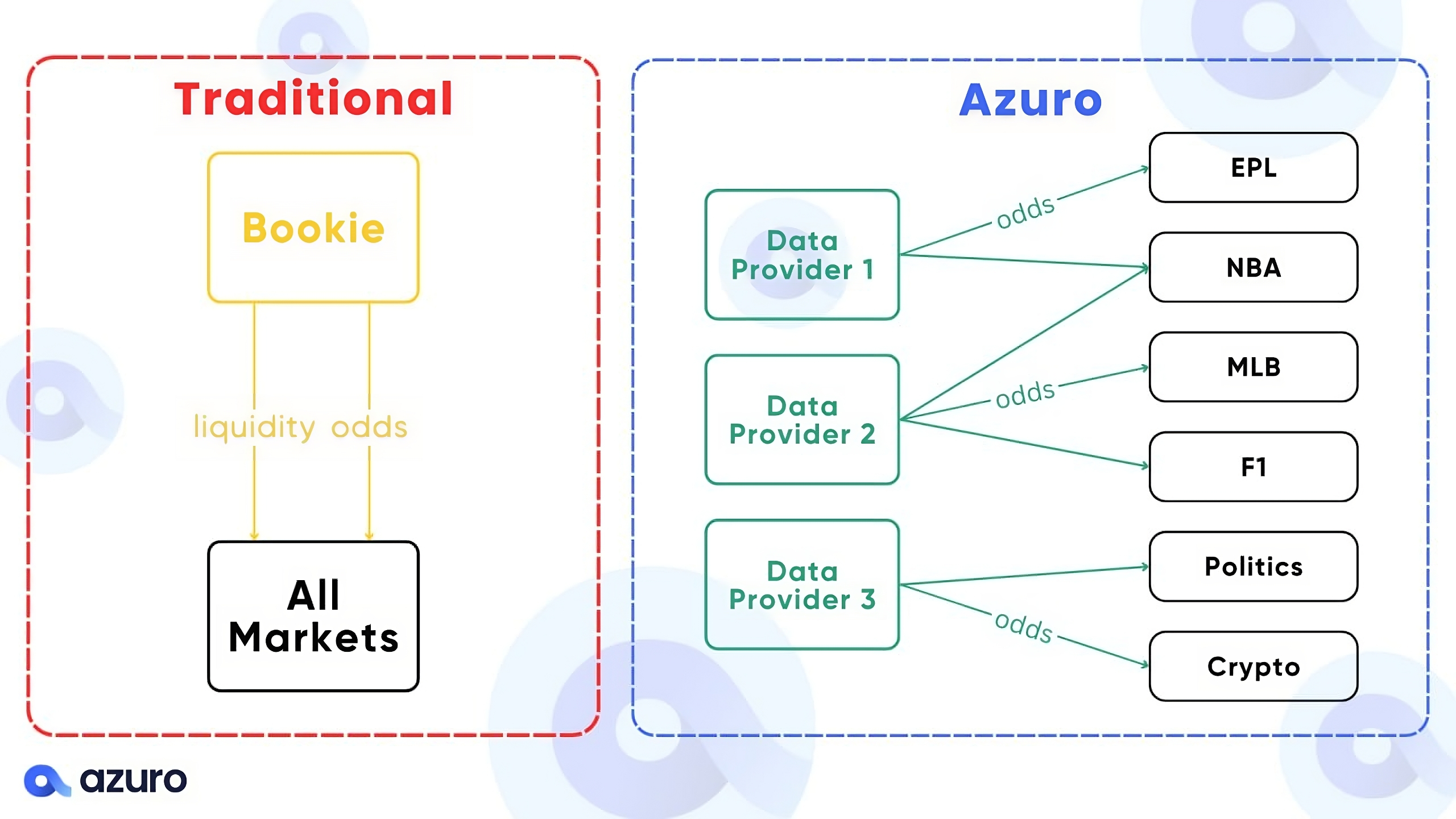

Oddsmaking on Azuro is a race to the bottom: Data Providers compete for the right to stream odds for certain events. With no custody / legal / operational risk (”cost of trust”) inherent to being an oddsmaker on traditional betting platforms, Azuro Data Providers can be literally anyone with an internet connection: the only prerequisite is to have specialized knowledge in the markets you’re providing odds for, as well as the necessary reputation for AzuroDAO to elect you into the set[*].

Just like how social media lowers the barriers of entry and shifts the makeup of information transmitters from entrenched MSMs to any citizen journalist, Azuro lowers the barriers of entry and shifts the makeup of oddsmakers from a few privileged entities entrenched with extensive regulatory moat and banking connections, to anyone of merit possessing specialized knowledge in the field.

Alas, you get the best possible sell-side odds sourced purely from competition, unbound by the cost of trust. In Azuro, Data Providers are just software service providers, not custodial entities akin to the traditional oddsmaker on a betting platform.

This is how the protocol, despite relatively lower levels of activity and TVL when compared to centralized betting behemoths, is still able to offer the best odds for most events.

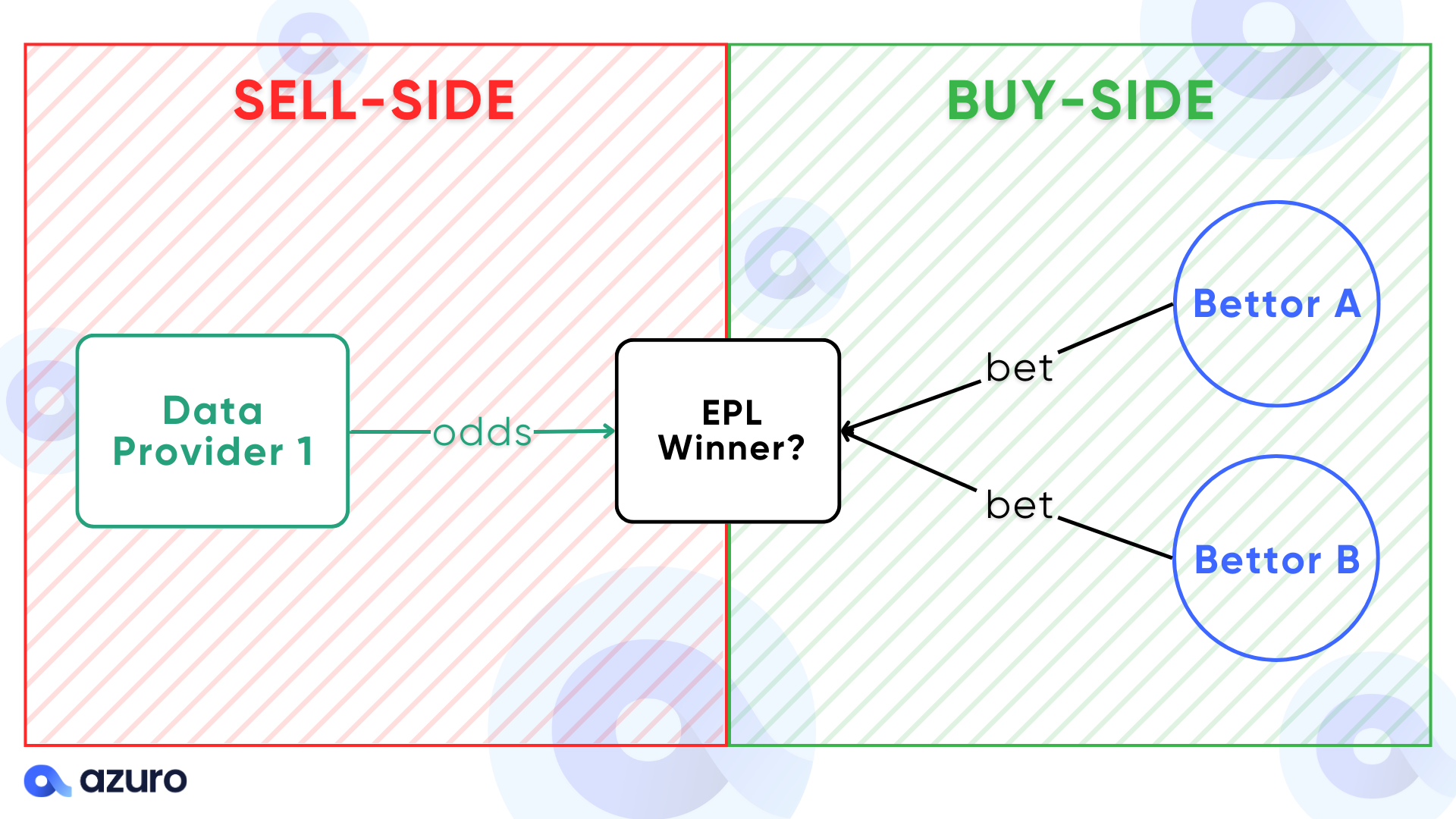

However, the odds derivation process doesn’t end here (else Azuro would be just another betting platform). The beauty of Azuro prediction markets, lies in combining offchain oddsmaking (sell-side odds) with onchain betting flows (buy-side odds): bettors from around the world can come in and place their bets if they feel the sell-side odds are still mispriced.

This makes up the buy-side oddsmaking component on Azuro: every bet placed on an outcome will shift the sell-side odds that is originally streamed by the Data Provider, pushing onchain odds to reflect the equilibrium between the Data Provider’s opinion and the free market’s opinion.

As each Azuro prediction market runs under the vAMM mechanism, it gives onchain bettors the ability to shift the Data Provider’s sell-side odds all the way to the ‘actual’ free market equilibrium.